QuickBooks Interface

QuickBooks is payroll management software that handles payroll, inventory, and sales. Advantage can produce QuickBooks compatible daily sales reports for CenterEdge customers. In QuickBooks, these entries will be called�CenterEdge Sales,�Daily Sales, or something similar under a customer account to which both applications have access. The�End of Day Balance Report�in Advantage is the model used to post daily information to QuickBooks.

Set up QuickBooks Desktop

Chart of Accounts

Category Sub-CategoriesCategory Accounts- Computed income account (i.e., bank accounts for cash, checks, and debit): This is where all your currency accepted in Advantage will be grouped.

- Credit card accounts: Credit card types can be mapped into individual accounts or into individual credit card accounts.

- Over/Short Account: Where any till over / shorts will be posted.

- A/P Sales Tax Account: Sales tax accounts must be associated with a Vendor.

-

Adjustment Account: Posts daily discrepancies which have not been accounted for.

QuickBooks requires that all General Journal entries debits and credits must balance to zero, so it is important to use this general purpose account so that the information can be posted into QuickBooks. A new Category / Sub-Category created in Advantage can cause discrepancies when sales are generated using the new categories without being mapped in QuickBooks.

- A/R Account: Used for employee or customer purchases, as well as Groups event purchases, where charges will be collected at a later time.

- QuickBooks does not allow posting to A/R Accounts in a General Journal entry, so the A/R account in QuickBooks must be set to Other Assets type of account.

- Write Off Account: Employee purchases charged to A/R and then are written off as a payroll deduction or possibly a bad debt that is being written off will be posted into this account.

- Other Deferred Revenue Account: Holding account for future sales.

QuickBooks requires that all General Journal entries debits and credits must balance to zero, so it is important to use this general purpose account so that the information can be posted into QuickBooks. A new Category / Sub-Category created in Advantage can cause discrepancies when sales are generated using the new categories without being mapped in QuickBooks.

Customers, Vendors, and Classes

Customers: You need to create one Customer to assign to Advantage, usually called CenterEdge.

Vendor: This would be something like the NC Department of Revenue, which you need to associate with sales tax accounts.

Classes: These are not enabled by default and aren't required, but are useful if you need QuickBooks to segregate Advantage data imported from multiple locations.

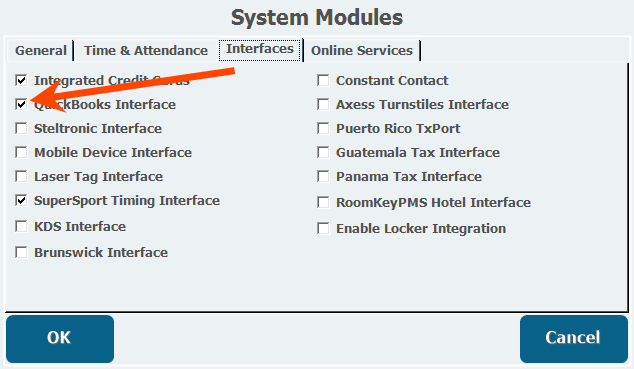

Enable the QuickBooks Interface

If the QuickBooks integration is installed, you can enable it for use in Manager Console.

Apps & features- From Manager Console, click�Maintenance.

- Double-click�System Settings.

- Double-click�Modules.

- Open the�Interfaces�tab.

- Select�QuickBooks Interface.

- Click�OK.

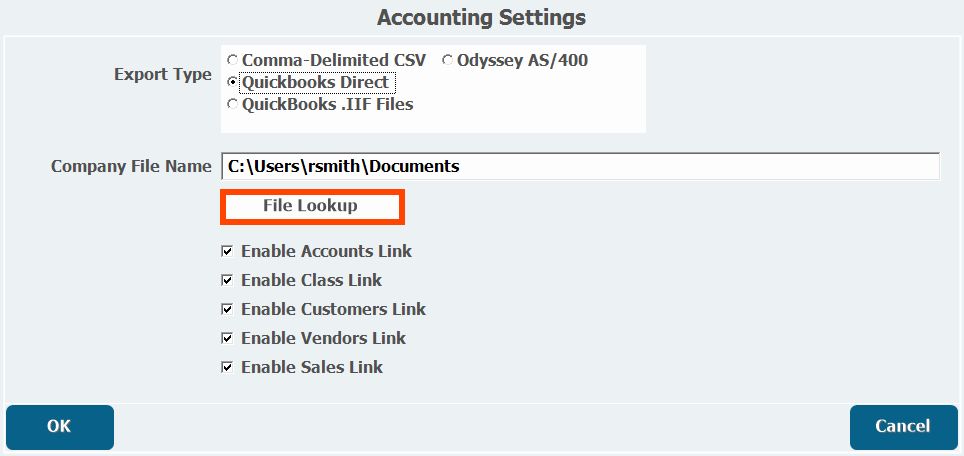

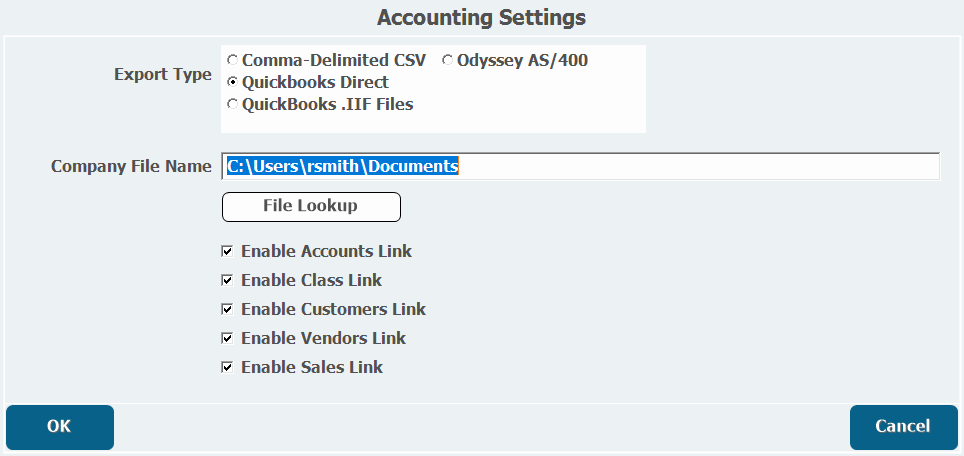

Set Up QuickBooks in Advantage

-

From Manager Console, click�Cash Control.

-

Double-click�Accounting.

- Double-click�Settings.

- Select�QuickBooks .IIF Files�(IIF method) or�QuickBooks Direct�(direct method).

The Export Types are described below.

- Select Enable Accounts Link, Enable Customers Link,�Enable Vendors Link, and�Enable Sales Link.

Direct Method

The�Direct�import allows direct access between Advantage and QuickBooks for setup and sales data. When using the direct import method, all Advantage-QuickBooks functions must be performed on the same computer as the QuickBooks application is installed. This method cannot support multiple location data imports.

- From the Accounting Settings window you accessed above, click File Lookup.

- Browse to and select the QuickBooks company file.

- Click Open.

File Import (IIF Intuit Interface Format) Method

IIF are proprietary file types for storing QuickBooks information. The IIF import/export option is more time consuming, but allows all Advantage-QuickBooks functions to be performed on any computer, and multiple locations are supported (e.g., the customer can hire an off-site accountant). For companies with multiple locations, the corporate module can be used to pull IIF files for import into QuickBooks. All data, including the setup and daily sales reports must be exported from or imported to QuickBooks. Any changes made in QuickBooks must be exported from QuickBooks before they are imported into Advantage.

- From the Accounting Settings window you accessed above, click Directory Lookup.

- Browse to the folder where you store the .IIF files.

- Click Import next to the relevant categories below, and select the correct .IIF files.

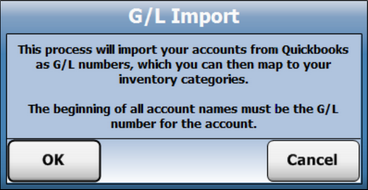

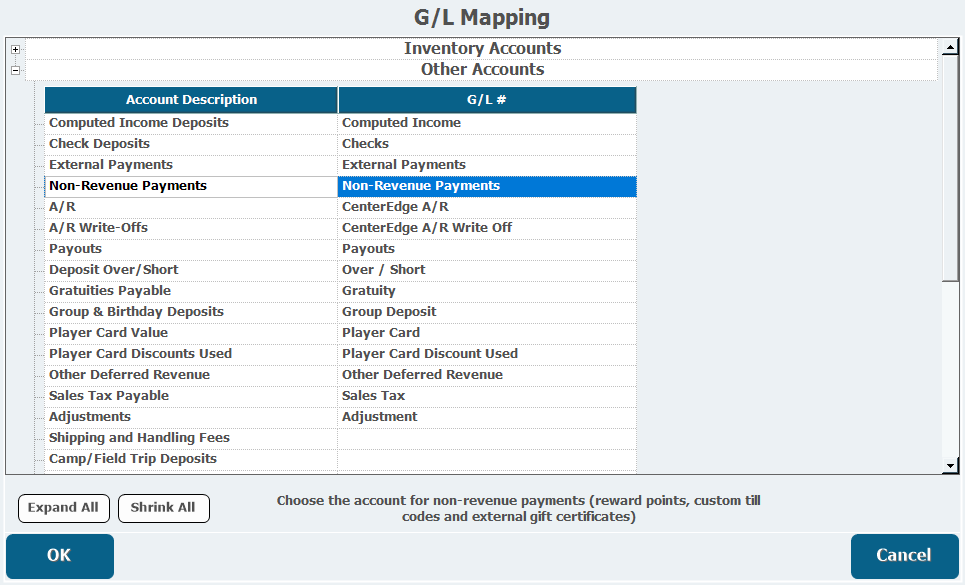

G/L Mapping

- From the Accounting window, double-click G/L Import.

- Click�OK.

- Double-click�G/L Mappings.

- Connect the appropriate information with each account by selecting an associated G/L # from the pull-down lists.

- Inventory accounts have Sales, Inventory, Cost and Waste G/L#s that can be individually assigned. You can associate entire inventory categories, sub-categories, or stock rooms to these G/L#s.

- Inventory accounts have Sales, Inventory, Cost and Waste G/L#s that can be individually assigned. You can associate entire inventory categories, sub-categories, or stock rooms to these G/L#s.

- Click�OK.

- Double-click Credit Card Account Mappings.

- Associate each Credit Card Type you use to a G/L Number.

- Click OK.

- Double-click Sales Summary Export to create a new journal entry in QuickBooks.

- Select a Starting Date for Update and an Ending Date for Update to choose what time frame to export.

- Each day will be a separate entry.

- Click OK.

- mapping2.png

40 KB Download

- import.png

30 KB Download

- modules.png

20 KB Download

- image2018-11-19_15-42-44.png

50 KB Download

- image2018-11-19_15-40-34.png

200 KB Download

- QuickBooks-Method.png

30 KB Download

- QuickBooks-GLMapping-Sales.png

200 KB Download

- QuickBooks-GLMapping-General.png

100 KB Download

- QuickBooks-GLMapping-CreditCards.png

70 KB Download

- QuickBooks-GLImport.png

50 KB Download

- QuickBooks-EnableInterface.png

40 KB Download

- QuickBooks-Assign.png

200 KB Download

- QuickBooks.jpg

50 KB Download

- Qb_access.png

90 KB Download

- CreditCard_Mapping.png

20 KB Download

- 788px-Gift_Cards.png

200 KB Download

- QuickBooks Integration3.mp4

10 MB Download

- QuickBooks Integration2a.mp4

20 MB Download

- QuickBooks Integration1.mp4

10 MB Download