3 Ways to Make Collecting Guest Payments a Breeze

CenterEdge’s Click to Pay features offer a secure, more convenient payment process for guests in three core areas of your business.

Consumer buying trends are shifting rapidly, and buyers need easy ways to buy from you. Whether they’re booking an event, paying their accounts receivable balance, or paying for their drink tab, they want convenience and security.

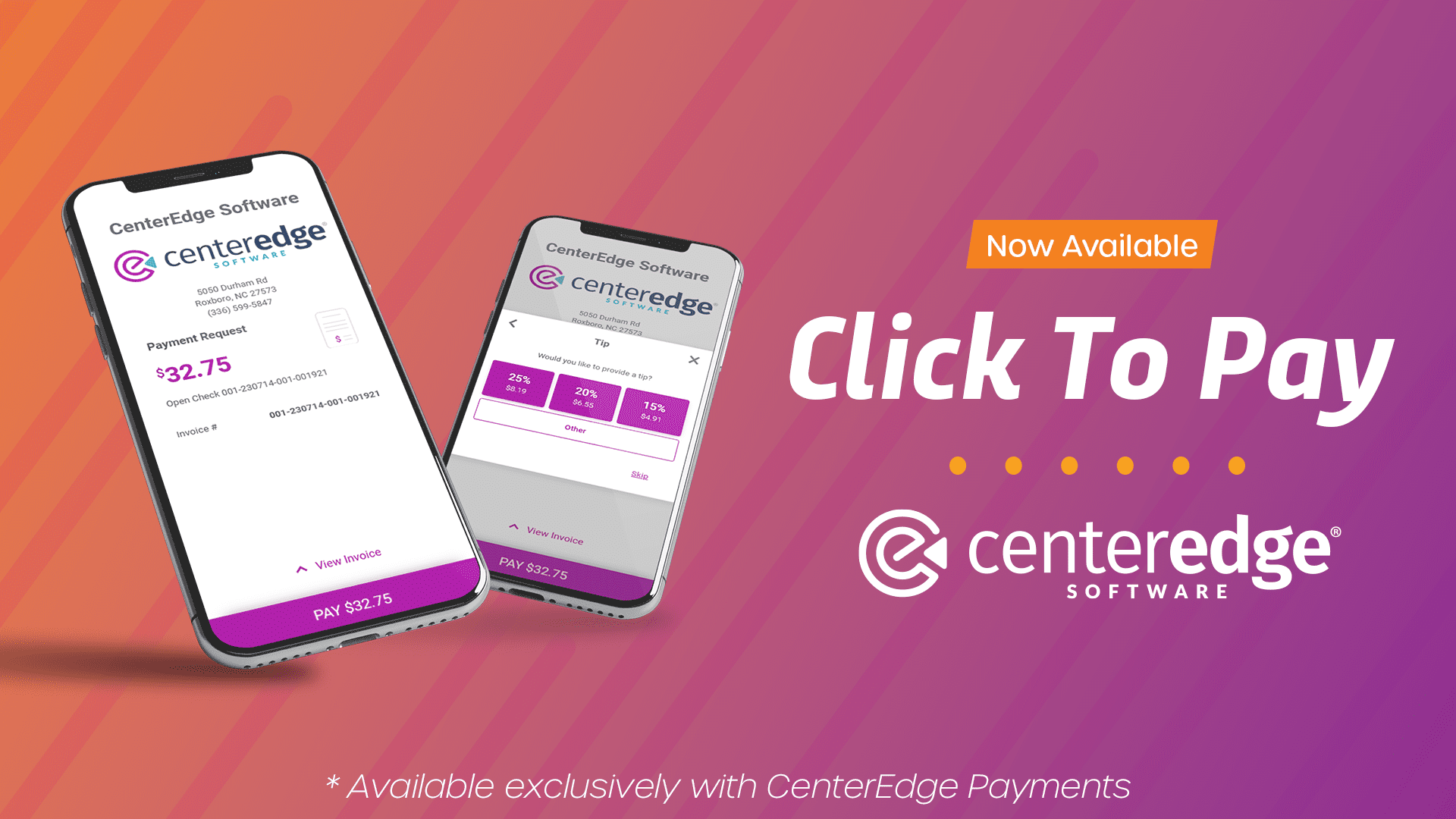

To help you deliver both, CenterEdge has developed a suite of features that will allow guests to pay by visiting a secure link known as Click to Pay,* available exclusively with CenterEdge Payments.

Read on for three key areas where Click to Pay can help offer your guests a new way to pay, while helping your business…starting today.

No. 1: Secure Payment Link for Group Deposits

Booking events has never been easier. When guests call to book, you no longer have to take deposits over the phone as you can now email a secure payment link at the time of booking. This means you won’t have to be near a payment terminal to take a deposit, take credit card numbers over the phone, or wait for guests to come in to make deposits.

This new feature helps keep guest information safe and eliminates human error when manually entering card information. Payment data will be tokenized, meaning that guests won’t have to present their card while onsite to settle their final bill with the same card.

Deposits and other payments made in advance of the event via secure payment link will be automatically tracked and deducted from the event balance. Optionally, the final event payment can be requested using Click to Pay on the day of the event. When presented with a final invoice, guests are prompted to pay gratuities of 25%, 20%, 15%, or a custom amount, which are calculated on the event total, including any previously made payments.

No. 2: Secure Payment Link for Accounts Receivable

In addition to sending secure payment links for group event deposits and payments, Click to Pay also allows you to send payment links and take payments for accounts receivable purchases as well. Team members, schools, companies, and any other organizations that you allow to charge to accounts receivable will be able to save time by paying via credit card online rather than having to process and send a check. This process will save you time and money spent on collection efforts while offering account holders more convenience.

No. 3: Pay at the Table for Faster Restaurant Check-Out

Many businesses are operating with reduced staff, and that means servers and managers are having to cover a larger area in restaurants and cafes. Now, servers can save time with CenterEdge Pay at the Table.

Click to Pay’s Pay at the Table feature allows you to distribute guest checks with printed QR codes that guests can scan to pay dining checks and bar tabs online from their mobile devices. Guests visit a secure payment portal and can be prompted to add 25%, 20%, 15%, or a custom tip amount if desired. Tables can be turned faster, and guests can be back in your facility playing and enjoying your attractions sooner than ever before by eliminating the back-and-forth of taking and running cards at the point of sale.

Along with the QR code, checks can be printed with customizable text, such as “Save time. Pay at the table,” to help inform guests what to do.

Changes to an order after a check has been dropped? No problem. Once new items are added to a check, payment links are updated automatically so you don’t have to worry about the hassle of reprinting checks or processing the wrong payment amount from an outdated QR code.

The new suite of features helps you give your guests more control over how they pay while saving you time and minimizing data entry challenges or errors. Click to Pay is available exclusively with CenterEdge Payments, and works seamlessly in conjunction with Dual Pricing and standard pricing programs. To learn more or to get started with Click to Pay, contact cepayments@centeredgesoftware.com.

*Additional program fee applies.

Search Resources

Subscribe to Email Updates

Featured Resources

News //

CenterEdge Chosen as Exclusive Software Partner for Launch Entertainment Growth Plan

Blogs //

How to Build Better Relationships With Your Guests

Blogs //

7 Steps to an Improved Guest Experience

Blogs //

5 Features of CenterEdge’s New Integration with Semnox

Posts by Topic

- Advantage Payments (7)

- Brand Management (19)

- Business Growth (81)

- Capacity Management (2)

- CenterEdge News (30)

- Client Interviews (9)

- Credit Card Processing (3)

- Data & Reporting (12)

- Digital Signage (1)

- Event Management (20)

- Facility Management (10)

- Food & Beverage (8)

- Guest Experience (34)

- Guest Management (20)

- Holiday Season & Promotions (5)

- Industry Events (12)

- Inventory Management (1)

- Loyalty Programs (8)

- Marketing Tips (24)

- Operations (1)

- Point of Sale (10)

- Product Launch (11)

- Productivity (5)

- Profitability (35)

- Redemption Management (1)

- Sales (35)

- Season Passes (1)

- Team Training (60)

- Waivers (2)

Leave a Comment